Opinions and Papers

These papers are distilled dispatches from the energy frontline. None of the collations of notes and materials below is intended to indicate that legal materials needed to make an assessment are complete. No legal advice is offered in providing these materials.

They are, however, food for thought.

2023

Getting a Corporate PPA - (December 2023)

Businesses want low energy costs. Absent that, they want certainty about energy costs and to fix those costs (or an element of them) below predicted future energy prices.

They also (right now, it is very much an also – but pressing nonetheless) want to go green, and to advertise themselves as being green. Subject to the proviso that going green is cost-effective.

One way businesses have been looking to go green and tie in lower costs is...

The Waiting Game - (November 2023)

Where projects are, right now, is waiting – waiting for the distribution networks to deliver on their agreement with Ofgem (all of them to be acting in tandem) to connect batteries to their networks, as a prelude to enabling them to connect other renewable plant.

They agreed to connect them soon because they recognise that the current situation is urgent. In doing so, they agreed to sidestep the issue of network reinforcement because reinforcement is not needed.

While projects are waiting to be given revised connection dates at some plausibly early time, the distribution networks are...

Connecting Renewables - (October 2023)

Things are starting to move on the connections front. In the past (i.e., before now), renewables developers who wanted to connect to the network were told that they could connect at some unspecified time in the very far future or they were told that they could connect when, at some unknown time, the transmission network had built a large number of new assets.

That has changed; just a bit. Over the next two months battery developers holding one of these old-style connection offers will receive letters from their network company amending their...

A Labour Reset - (September 2023)

The August Energy Update argued that Labour’s target of 100% clean electricity by 2030 was unachievable. It also argued that the government’s target for the same thing by 2035 was unachievable.

Labour’s 2030 target is the core of its energy policy – from that all the other parts of the policy spin out. The target itself has two parts: part 1 100% carbon-free electricity; part 2 how much households and businesses will save with the 100% target.

If this two-part target can’t be achieved, much of Labour’s other energy policies...

Does Labour have a convincing energy policy? - (August 2023)

We know, we think, the outcome of the next general election. We might be wrong of course, but we generally don’t add into our thinking the sort of unforeseen scenarios that would make us think we are probably wrong. In the absence of entertaining the unforeseen, we now have to take seriously Labour’s energy policy.

We need to distinguish between Labour’s energy policy and Labour’s other policies that impinge on energy. The energy price freeze is a case in point. This policy was announced in August 2022 to extend the-then price cap for domestic customers over winter 2022-2023. A crucial part of the announcement was...

Regulation of Networks - (June 2023)

RIGHT NOW THE INABILITY of a hypothetical 10MW solar farm or 10MW battery to get built and start operation is caused not by the network to which it wants to connect but by the transmission network.

At the same time, our hypothetical scheme is being forced to sign a contract that reeks of monopoly power. The contract for the distribution network does the following:

-

lists transmission works as a prelude to connecting to the distribution network

-

provides that where costs are unknown, connecting schemes must still pay

-

provides for ‘extra requirements’, so extra costs for connecting schemes to pay

-

the date for completion of the works is unknown or often mid-to-late 2030s.

The costs to our small hypothetical scheme may be so great to make it...

The Connections Mess – (April 2023)

Why Can’t Battery Projects Connect?

THE STORY BEHIND THIS QUESTION is long and convoluted. It remains without answer even though National Grid indicated last November that it would shortly be changing the way it viewed storage. It would, it then suggested, treat storage as being unlike active generation (generating at the same time as all other plant and so placing a demand on an over-burdened network rather than, as has consistently been argued by battery developers...

Biodiversity Net Gain - (March 2023)

FROM NOVEMBER this year planning consent for development of a site will be subject to an obligation to improve the biodiversity of that site by 10%.

Regulations (due to be published soon) will exempt some developments. It’s worth noting that brownfield sites will not be exempt.

Small sites will be caught in November 2024, one year later. These are physically small sites with small numbers of homes or, for anything else, sites of >0.5 hectares. No site will be counted as small if its...

A Net Zero Failure - (February 2023)

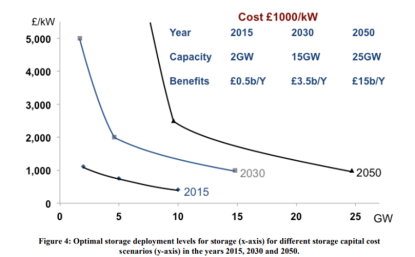

IN EARLY 2016 the NIC published a report outlining requirements for network development, stressing the pivotal role of flexibility via storage, demand-side response and new technologies.

It contained the following table summarising the costs and massive benefits of storage:

Seven plus years later, where are we?

2022

The Price Crisis - (August 2022)

THERE ARE REPORTS of crowds outside Ofgem’s offices in London and Glasgow, gathered to protest against the fact and operation of the price cap.

Ofgem in its defence argues that prices are out of its hands, that the cause of the problem is gas and the rise in gas prices is driven by the war in Ukraine and (but to a much lesser extent) by increased...

Being Specific - (July 2022)

LAST June, the Climate Change Committee published its annual Report to Parliament, Progress in Reducing Emissions*.

Over a month later, the decision of the ‘Client Earth’ judicial review was published.**

The judicial review involved a back and forth about the legality of the government’s Net Zero Strategy (NZS) with reference to two provisions in the...

Counting To Zero - (May 2022)

I HAVE PREVIOUSLY REPORTED on the connection problems for batteries. Many battery projects won’t be able to connect for the next six-to-eight years from today.

This moratorium on connecting batteries is not local. It is widespread.

The cause of the delay is that National Grid says it must reinforce parts of the transmission system before more plant can...

PROGRESS TO NET Zero? - (Aril 2022)

LAST OCTOBER the government announced key policies for net-zero—updated by it in an APRIL policy paper.*.

The policies involved revolve around five themes: offshore wind, onshore wind, solar, hydrogen and networks/flexibility.

The hydrogen targets, aims and ambitions have been outlined before++ and there is little more to be said of them. But what of the rest?

Ofgem on Storage - (February 2022)

IN THE SUMMER OF 2021 the government published a slew of policy papers, all intended to increase system flexibility. This was recognition that intermittent generation (solar and wind) is predicted to increase substantially (a handwave at ~300% per technology isn’t out of place)*.

Yes, the policies were thin on detail and thick on the 'we hope to'. But still, they were policies with a flexibility end-goal.

Ofgem’s latest ‘minded to’ publication (see later) does...