Cheaper Clean Power

September 2025

Electricity has both costs and prices. Labour promised a £300 reduction in domestic electricity bills by 2030 and said that only clean power would run the electricity system by that date. That promise makes sense if there are plans to bring prices down and to keep costs low.

What will Make Prices Come Down?

GB electricity costs are high. Gas sets the price for wholesale costs for ~98% of the time. Thus for ~98% of the time gas is needed to run the system and, since the wholesale market works on the principle of marginal pricing (the cost of the last, the marginal, fuel, dictates the cost of all other fuels), whenever gas is needed (given that it expensive) wholesale costs are high.

In France and Germany, where price-setting generators are more often nuclear and coal, gas is also the marginal fuel but sets prices only 7% and 24% of the time, with most other European countries falling between the two. As a result, gas has a smaller role to play in their wholesale markets and their electricity prices are lower, or much lower than ours.

If gas is always the marginal fuel (and sets the price when used), the amount of time it needs to be used is key to wholesale prices. The more generation there is that doesn’t use gas, the fewer the occasions on which it’s the price setter and, therefore, (in principle) the lower the wholesale price overall.

In GB most electricity generation on which we rely other than gas is intermittent. It’s wind and solar and the government’s development plans are for much of the same (with a bit of biomass and waste incineration thrown in). But the Clean Power 2030 Action Plan said: “Electricity generated by renewables and nuclear power will be the backbone of a clean electricity system by 2030”.

If that were so, the reliance in the wholesale market for power from gas would fall and it would fall by the amount of nuclear power on the system.

Will that be the 2030 picture? Small modular reactors are still nascent; the first is planned for the mid-2030s (and is still dependent on getting the design details right and when it is installed it will still be at trial stage). As for other nuclear plant, Sizewell B will still be running at just 1,19MWe and all other nuclear plant will be decommissioning - except for Hinkley Point C with just 3.2GW, which may come on in 2030. Let’s suppose it does. It is estimated that it will supply 7% of GB’s electricity. But at the same time (or thereabouts) more nuclear power will have decommissioned than Hinkley Point C is adding, so times when gas sets the marginal price is unlikely to decrease.

There are other clean fuels but none in substantial quantities. What that means for the foreseeable future is that gas will continue to play a major role in the system. Can the effects of gas on the wholesale market be ameliorated in other ways?

There is the carbon capture scheme. Two CCS projects have reached financial close and plan to start operation in 2028. So far as electricity output is concerned, it isn’t intended that CCS gas do more than act as backup at only 35GW (5%); it isn’t intended that GB be defended against gas prices used by that 35GW. This isn’t a scheme that deal with the role of gas as a marginal price setter in the wholesale market.

Then there is the Cap and Floor Scheme for long duration energy storage. It will start operation in 2030 and aims at a figure of 2.7-7.7GW LDES. We won’t know until Q1 2026 how plans have panned out. What will happen, if the Cap and Floor scheme succeeds and enough LDES is built is that it will avoid the need for intermittent generators to be turned off, it will avoid the need for gas top-up for the periods it runs. So in those periods the need for gas will be nil. But the system has two needs – dealing with intermittent generators being turned off and dealing with demand that exceeds available power. To deal with the latter there needs to be much more power. We know (see Update December 2024) that there won’t be enough non-gas power by 2030. So for the moment, what a successful Cap and Floor scheme means is that by 2030 the system will be able to run on intermittent power outside intermittency intervals. It doesn’t mean there will be enough power. It will mean lower prices (lower gas demand) in the periods when LDES runs. But right now by how much is an entirely moot question.

Government has plans for a national market which are yet to be published (Q3 this year). Watch this space: we may see some ambitious proposals for dealing with (for ringfencing) gas in the price mix.

And while it is true that gas prices are coming down and LNG is ‘softening’, betting on markets isn’t something a government can afford to do.

What about Costs?

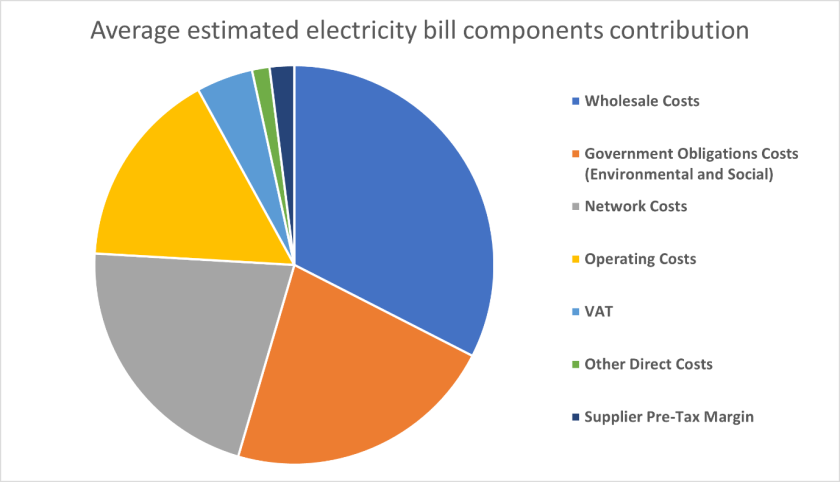

That is all about price; it doesn’t deal with costs. The pie chart below (Imperial College, derived from Ofgem 2020 data) is illustrative. https://electricitycosts.org.uk/electricity-bill-charges/

Most of these costs will remain broadly constant, out to 2030 with some small increase for the orange segment: as Contract for Differences increase, the RO and the FiT will both come to an end, so the rise in obligation costs will be minimal. As for the other segments – excluding the blue and the grey – there may be small changes but, again, they are expected to be minimal.

Network costs (the grey segment) are due to increase as both transmission and distribution networks are built. Ofgem’s view is that will require £80bn up to 2031.The new Cap and Floor scheme will be supported financially by NESO, which means an additional element added to the networks bill.

The grey segment for network costs is dealt with in domestic bills as a standing charge and in business bills (mainly) as a banded charge with band level related to consumption. Both will be affected by higher network costs.

Transmission charges and questions about how to smooth them out in bills are currently under discussion. Distribution charges Ofgem has put to one side: it wants first to consider and consult on how network charges are to be allocated between different consumers. It is looking at a range of options.

Essentially, the options for domestic customers are different ways of dealing with the standing charge (the grey segment), ranging from scrapping it in favour of adding it to the commodity costs, to varying charges for time of use to, in the end, a “progressive approach” involving ability to pay. As Ofgem notes, most of the options involve complexity for suppliers, some run the risk of under-recovery and some seem not to be wholly fair. In that context, the progressive approach has a superficial attractiveness.

The questions for businesses (whose banded standing charges have already been changed, causing complaint as some have risen substantially) are the uninspiring (because apparently uninformed): “what options for amending …cost allocation and recovery should we explore in more detail and why?”

There is also a proposed option to reallocate proportions of network costs borne by domestic consumers (40%) and business consumers (60%), so adding more to the business bill.

Ofgem has set out all the factors it will need to consider (fairness, proportionality, etc.) and variations on the options, noting that “progressive pricing” is a matter for government and that it now has a statutory obligation to take economic growth into account. On the basis of the latter, increasing costs businesses pay to reduce consumer costs would seem counterintuitive.

None of this answers the question: how big will the grey segment be and for how long. Networks are considering a pricing regime for five years, which may not give investors sufficient cost certainty if there are further rises after that time and Ofgem has kicked distribution costs into the long grass until it is decided who pays the costs and how.

Bringing Down Prices and Dealing with Costs

Unless the wholesale market is ringfenced from gas; or firm capacity is available when intermittent sources aren’t; or much more intermittent capacity is available matched by LDES; wholesale prices will continue to be dictated by gas much of the time. Extra capacity could come from nuclear plant, just not in the near future. LDES will make a difference to wholesale prices (exact figures won’t be calculable until next year), but won’t remove the role of gas in price setting, though it will reduce it by the amount of time gas isn’t needed. LDES is important, but it’s not the answer to high prices.

As for costs, until smart meters are nation-wide, none of Ofgem’s options for the standing charge can be implemented: that won’t happen before the end of 2030. Decisions about those options and decisions about transmission and distribution charges are still all for the future. We don’t know the size of the costs bill for the different kinds of consumer nor do we know when we will know.

Things going well (a successful and ongoing LDES scheme, much more renewables coming on with each CfD round until 2034, Hinkley Point C starting and the first few SMRs rolled out) I estimate that prices will match Labour’s promise in the late 2030s/early 2040s. Depending, of course, on the make-up of the next government.

Cheaper Clean Power - September 2025.pdf

Adobe Acrobat document [195.8 KB]